As of October 14th, there are 7 new in vitro diagnostics listed companies in 2020, Another 3 companies have successfully approved by the committee meeting, and 9 companies are still in the queue. The listing wave of Chinese IVD companies should pay more attention to the historical investment opportunities in this market rather than the industry dividends due to public health incidents.

In vitro diagnostics (IVD) is tests done on samples such as blood or tissue that have been taken from the human body. In vitro diagnostics can detect diseases or other conditions, and can be used to monitor a person's overall health to help cure, treat, or prevent diseases. It is also known as the "Doctor's Eye". 70% of human treatment plans are based on in vitro diagnostic results that account for 2-3% of treatment costs.

As the cornerstone of medical treatment, in vitro diagnostics is a significant segment in the global medical device field. According to data from Evaluate MedTech, The sales of IVD industry in 2019 reached 52.6 billion dollars in worldwide range, accounting for 13%. In the market structure of Chinese medical device market in 2017, imaging diagnosis accounted for the largest proportion at 16%, followed by IVD with 13%, which is similar to the global medical device market.

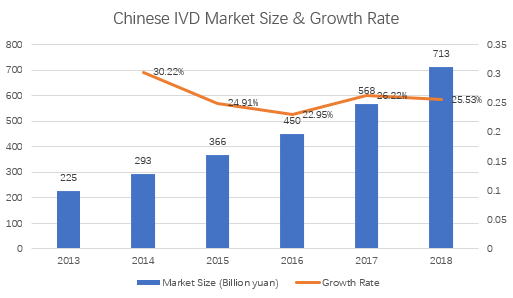

At present, Chinese IVD costs account for a relatively low proportion of the entire medical expenditure, but it still maintains a trend with rapid growth. Globally, The average cost of IVD per capita in China it is only $7.1, while it is $70 and $20 in North America and Europe respectively. Chinese IVD market still has a lot of room for growth. In 2018, the Chinese IVD market was 71.3 billion yuan, and the industry average growth rate in the past five years was 24.9%. It is expected to continue to grow by 20+% in the next few years, far exceeding the global average growth rate of 3-5%.

Regardless of the scale of the market or the growth space, Chinese IVD market can be regarded as an excellent investment field in contemporary.